No.1 MONITORING APP![]() IN YOUR TOWN

IN YOUR TOWN

Reveal Hidden Truths with the Most Reliable Tracking App

Know Their Every Move with Our Best Tracking Software for Cell Phones and Computers

9000+ People can not be wrong, Always Stay Updated about Their Activities

From 9000+ reviews

Empower your spy skills with these 6 innovative phone features

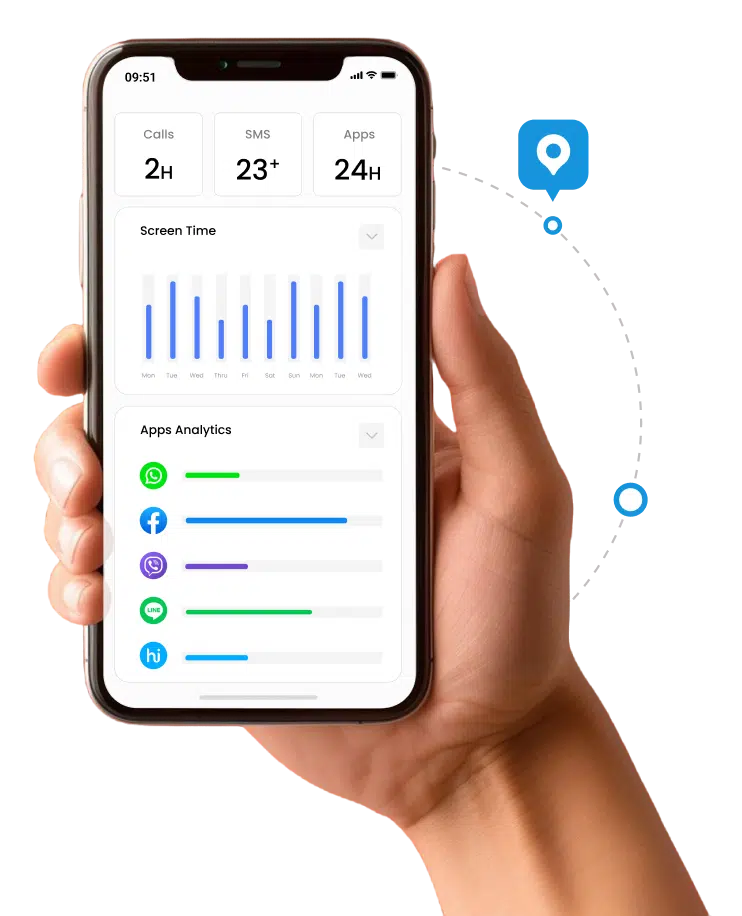

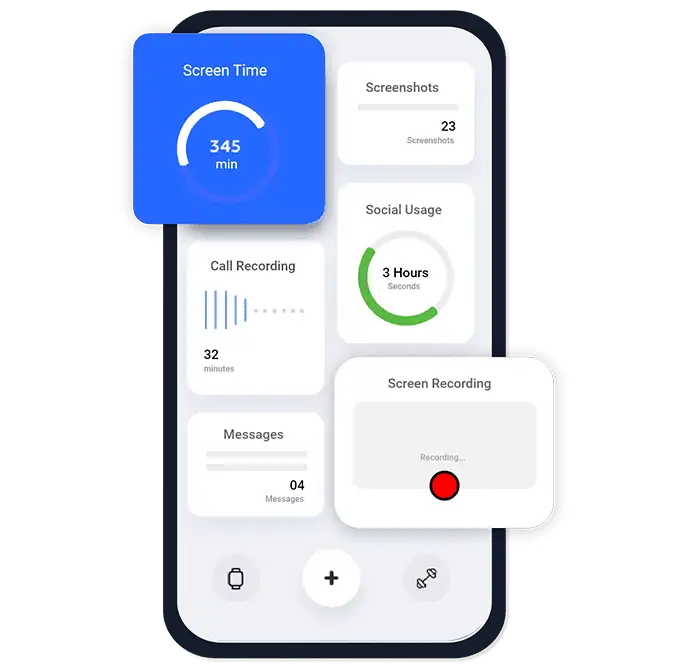

TheOneSpy is the best discreet monitoring app. Its enhanced functions help users monitor, track, and record the actions of kids and workers from anywhere and at any time. It has a dozen features that allow you to track the device effectively. Users can use it without complicated steps on Android, Windows, or MAC devices.

Precision Meets Perfection: The Epitome of Quality Features

In addition, with TheOneSpy, you have many exclusive features that allow you to check the activities of the targeted device remotely. It provides you with complete access and control over the targeted device. The best part is that it operates on the back end of the device in completely hidden mode. The following are some of the powerful features.

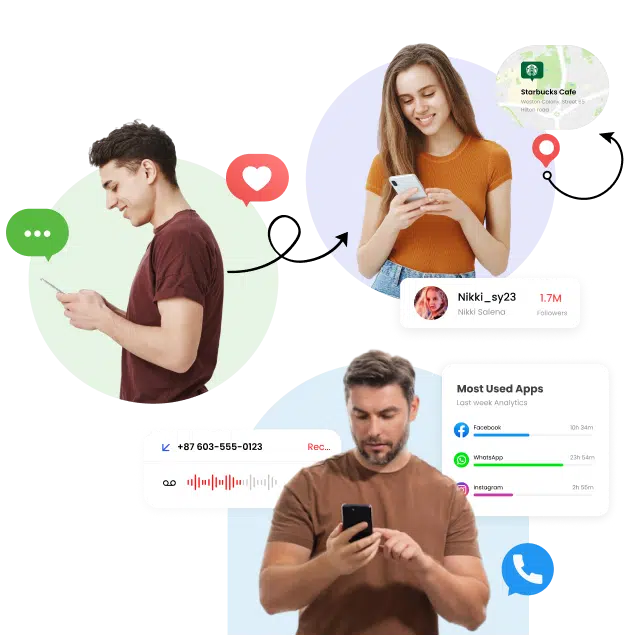

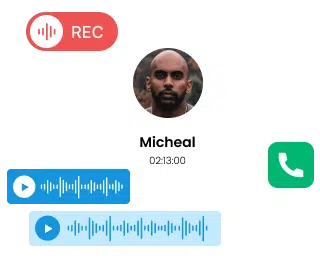

Call Recording & Logs

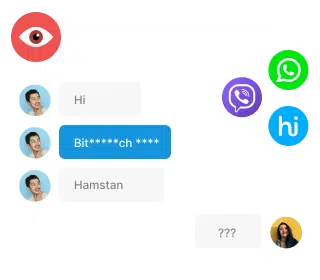

Monitor Social Media

Live 360 streaming

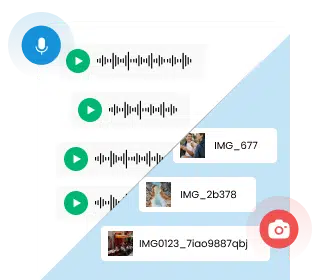

Mic & Camera Bugging

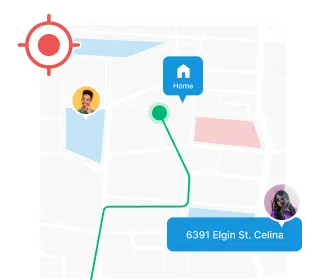

Track GPS Location

Monitor Photos Gallery

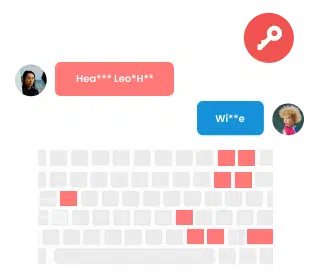

Keystrokes Logging

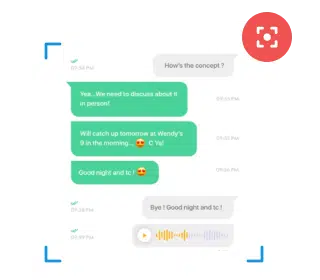

Screen Recorder

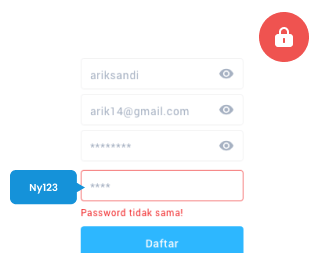

Password Chaser

Trusted by Over 100,000 satisfied customers

Editor’s Choice: Top-Rated Exclusive Spy Software of the Year

TheOneSpy isn’t just gaining attention in the tracking and monitoring industry, explore what the media is reporting.

With the rising demand for social media platforms, monitoring and managing are essential. Thus, TheOneSpy monitoring app respects the users’ needs and designs new features accordingly.

TheOneSpy recently update social media and instant messaging monitoring feature for Whatsapp, viber, line, instagram, skype, facebook, tinder, imo Wechat IMs.

TheOneSpy has leaped forward in Mac monitoring technology, introducing advanced features for seamless monitoring of Mac devices. With our latest update, users can experience the forefront of monitoring technology, designed to know kids’ and employees’ interests and keep them informed.

TheOneSpy has enhanced its Mac monitoring features. Now, users can have a smooth monitoring experience. Updated features with the latest OS compatibility….

TheOneSpy is a cellphone and tablet monitoring software developer that designs exclusive software for devices running on iOS, such as iPhones and iPads, Android, and Blackberry OS. Users can install it on any device.

TheOneSpy is taking another step further in its innovative and customer-centric monitoring experience. This time, the software maker is offering its customers a feature called “Unlimited Device Switch.

TheOneSpy is a good choice for monitoring your child’s cell phone, especially if they have an older model phone – it is compatible with BlackBerry devices as well as old and new iPhones

Parenting is a handful when you’re worried about your child’s activities. But that’s where TheOneSpy comes into play. We’ll help you decide whether the OneSpy app is an excellent tool to oversee your child’s activities.

It can be quite difficult for parents to protect their kids. Therefore, apps that provide parental controls can be useful. After considering other possibilities, you may have done some research to learn more about TheOneSpy.

Spy apps for Android and other gadgets can help parents in many ways. They can use the services to keep a check on the kids as parental control apps

This tool educates about the Hazards and vulnerabilities of social media in a Revealing Exploration and the best way to ensure the safety of your youngsters/children and to maintain a secure digital environment.

TheOneSpy Unveils Cutting-Edge Solutions for Parental Control in the Digital Age. While it offers vast informational and educational opportunities, it also exposes immature users to unsuitable content and the potential for cyberbullying.

TheOneSpy has announced that its features can help users create a safer online world for their children. With this, parents can monitor and educate on how to avoid online risks.

It is an app that enables users to snoop on cell phones connected to cyberspace. TheOneSpy has all the features that you expect spyware to have, from traditional to exclusive.

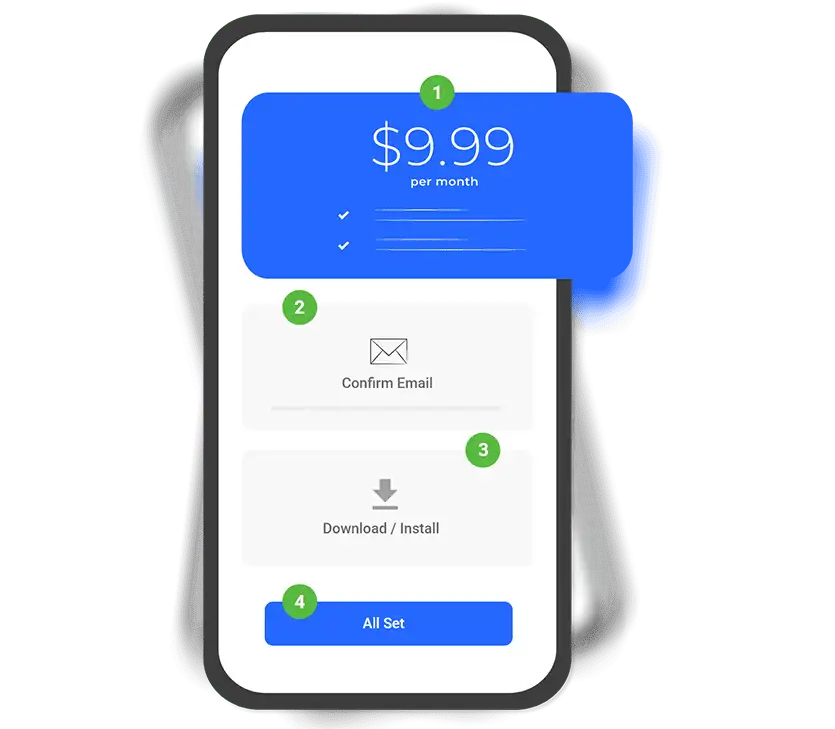

Absolutely not; TheOneSpy app can not used without physical access to the targeted device. It’s essential to configure the installation procedure required to access the device. However, one-time physical access is necessary to set up theonespy to monitor online activities remotely.

Users can monitor one device with a single license of TheOneSpy app. If they want to monitor multiple devices, they’ll have to purchase additional licenses for each device, which allows them to monitor different devices seamlessly.

Yes, TheOneSpy cell phone monitoring software works on Android 15. It ensures device compatibility by regularly updating the Android version for reliable monitoring.

No, TheOneSpy phone monitoring app invisibly operates in the background, which means it works without alerting the targeted users and never shows the app icon on the targeted device while monitoring.

Once you’ve configured installation on the targeted device, you’ll be able to access the web control panel. This online dashboard provides a comprehensive review of your targeted person’s online activities, such as text messages, chats, call logs, shared media files, GPS location, and much more.

If you find TheOneSpy does not work as you expected, you can claim a refund through email or chat with our customer support team. Our team takes the necessary steps to resolve your issues or proceed with a refund if your purchase falls within 14 days of our refund policy. Then, they will guide you through facilitating your refund.

You need to purchase a single license to track targeted devices. After purchasing, install it on the targeted device by getting physical access. This will allow you to access the web control panel top panel to monitor their activities remotely.

Yes, you can switch to the targeted device by following a few steps to transfer theonespy’s services. First, you’ve to uninstall the app from the test device and follow the re-installation procedure to get the app for a new device.

Installation with TheOneSpy by the blink of eye: the user just has to subscribe, install, and activate the web control panel to review online activities from the targeted device. To get more details about installation process click here.

One More Question?

Let us know, if you need some help and didn’t find an answer to your question.

Don’t let suspicions be a part of your relationship – Know the bitter truths with the spy app for mobile.